August 19, 2018

Anderson Exports is a Bulk Ingredients Sourcing Agency in Northern California. We specialize in sourcing the best ingredients from California, Brazil and the rest of the world. Our newsletter delivers actionable market intelligence to inform our clients' purchasing decisions.

Raisins

California raisins are about 3 weeks from harvest. The 2018 California raisin crop is healthy and developing well so far. Bunch counts recovered compared to the prior crop. The Raisin Bargaining Association (RBA) reported 33 bunches per vine for the current crop, up 22% from last year but still below the 10-year average of 37 bunches per vine. Weather, as we saw last year with the two unexpected rains during the harvest, is of course a key factor for a successful raisin harvest and will be especially in focus in the coming weeks.

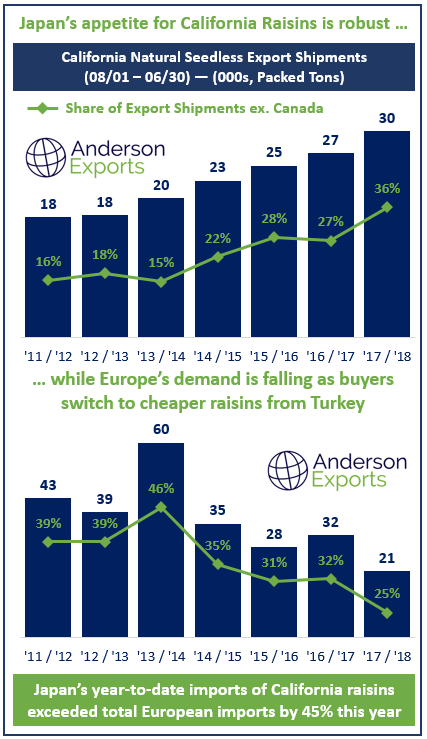

Prices for bulk California raisins will likely remain elevated even if the new crop is normal. The current raisin crop was the smallest since 1982 according to the RBA. Due to the record small crop this year, the carry-in for 2018 supply is estimated to be ~70 - 75K MT, or ~48% lower than the 5-year average. Demand for California raisins has built-up considerably in recent months as monthly shipment numbers lag severely behind recent years. Shipments of California Natural Seedless raisins were down by 41% in July compared to the prior year based on the latest report from the Raisin Administrative Committee (RAC).

California raisin suppliers are therefore eager to renew supply continuity for both domestic and international clients. Buyers are similarly looking forward to new crop, particularly for Select / Medium sizes of Thompson Seedless raisins which can be hard to come by at this point in the year. Midget / small sizes, which fall through the screens first compared to larger fruit, are available from the current crop at attractive levels.

After last year’s disappointing raisin crop in California, major importers turned to Turkey, Chile, and South Africa to cover supply in recent months. California processors even imported Chilean material to fulfill domestic customer needs. Chilean raisin exports to the United States increased by 54% from January - May of this year compared to last according to data from the USDA. While the swing is notable, Chile’s total raisin production of ~60K MT still lags the United States and Turkey by a substantial margin. For example, in a typical year, California ships ~20K MT of raisins per month so it would take only 3 months to ship Chile’s entire annual production volume. Nonetheless, quality from Chile this year has been excellent and we have loads available for prompt shipment from Chile for Thompson and Flame raisins.

Turkey’s new crop for raisins is also just around the corner. With the Eid al-Adha holidays ongoing, the market in Turkey will be slow for the next week. Turkey’s Minister of Agriculture, Mr. Pakdemirli recently announced the new crop estimate for Turkey at 261K MT. The actual figures often differ substantially from the government’s estimates so we will have to wait and see. Turkish Sultana raisins and Thompson raisins will be first shipped to Spain, due to its close geographic proximity, then to Europe and other export markets. Though Turkey has continued to grapple with observing strict pesticide controls, overall, the quality of Turkey’s raisin processing facilities is improving. For Turkish raisins, we supply from BRC and ISO 22000 suppliers to deliver the highest quality Turkish sultana raisins to our customers.

Trump’s recent spat with Erdoğan is causing major problems and concerns for Turkey’s trading partners. We have seen large fluctuations in the value of the Turkish Lira, which will certainly affect the rates at which raisins are offered to Turkey’s foreign purchasers. Due to the general uncertainty around the Lira, we have seen many Turkish suppliers reluctant to offer large forward contracts.

Iranian sultana raisin exports outside of the Middle East will face major challenges in the coming year due to the U.S. sanctions. Trump intends to clamp down on businesses and banks doing business with Iran. European buyers of raisins from Iran will likely turn to Turkey, Afghanistan, Uzbekistan, the U.S., Chile and South Africa this year due to these trade and sanction issues.

We specialize in sourcing the highest quality sun-dried raisins from California, Turkey, Chile, and South Africa and we we welcome your inquiries for dried-on-the-vine (DOV) and tray-dried Thompson Seedless, Selma Petes, Flames, Goldens, and other varieties in Jumbo, Select, and Midget sizes. Currently, we also have Chilean and South African raisins for prompt shipment.

Cranberries

Severe fruit shortages of sliced sweetened dried cranberries (SDCs) continued in recent weeks. Producers have no availability for prompt shipment. Lead-times to earliest shipment remain long and prices are high and have shown no weakness yet. The USDA decision on the 25% producer allotment (supply reduction) for the coming crop still remains unknown at this time. Given the substantial impact this decision will have on the industry and fruit availability, the tightness in pricing and supply may become even more problematic if the supply reduction is passed.

For buyers, the current situation is no doubt challenging. Prices have doubled over the last year and show no signs of relenting at this time. There is no longer a spot market for prompt shipment due to the shortages. The U.S. is also essentially the sole supplier of cranberries around the globe, besides a very small crop from Chile, so there are no actionable alternative supply origins for sourcing cranberries. Therefore, we urge our clients to discuss their cranberry requirements with us as early as possible in order to determine the right approach to covering forward needs for SDCs.

Walnut

The new walnut crop in California is looking good. Some walnut growers have been doing some cuttings in recent weeks and have reported that the color of the walnuts is better than at the same time last year, which is a positive sign. The Objective Walnut Estimate is set to be released in September by the California Agricultural Statistics Service (CASS) and should add further clarity on the size of the 2018 California walnut crop. Current estimates are in the 680 - 700K MT range.

Export sales have been slow in recent weeks due to the tariffs. Currency volatility is also adding to buyer reluctancy to book forward contracts. The market may pick-up after the details of the Section 32 buys are released. This is the relief channel for the walnut industry on the trade war. We expect market activity to pick-up in the coming weeks.

The Walnut Acreage Report for California released in July 2018 showed 335,000 bearing acres for California, a new record which positions the industry well for a record crop. The 2017 bearing acreage is composed primarily of Chandler (47%) followed by Hartley (12%), Howard (11%), Tulare (11%), Serr (5%), Vina (5%), and others (10%). There are also approximately 65,000 non-bearing acres for the 2017 year, according to the USDA. Chandler represents the 59% of the non-bearing acreage. These trees will begin to produce in the coming years, adding to the bearing acreage and total production.

California has the lightest and largest walnuts in the world. We supply in-shell and shelled walnuts for all major varieties including Chandler, Hartley, Howard, Tulare, Serr, Vina, and others.

Almonds

Foreign buyers continue to be cautious with forward contracts for the new crop. However, current-year almond shipments are still going strong through the typical transshipment routes into China via Vietnam, Hong Kong, etc. The July 2018 California almond shipment report showed July shipments at 143 mm lbs, down slightly from the prior year figure of 153.9 mm lbs. The lower committed shipments of 170 mm lbs, down 15.65% confirms the slow forward contracting environment. Global uncertainty on tariffs, foreign exchange volatility and a large crop may keep put a lid on pricing this year for some California almond varieties.

We anticipate almond prices to be steady. Cals are harder to come by at the moment. The Cal SSR crop is coming in a little short vs. last year. Growers and processors are expecting approx. 285 mm of SSR grade product this year. Supply is not keeping up with demand on SSRs so expecting firmer pricing there.

Pecans

The new California walnut crop quality looks good, although we still have another six weeks of summer weather to get through before we’re safe. In a hot year like this, well-irrigated orchards will perform particularly well. Georgia’s crop is looking especially strong with estimates in the 110 - 140 million lbs range. Estimates for the U.S. and Mexico pecan crops are in the 300 mm lbs and 330 mm range, respectively.

Our earliest new crop shipments are for late September / early October. We supply Fancy Junior Mammoth Halves (FJMH), Fancy Pieces, and other sizes / types for all major U.S. pecan varieties.

Pistachios

Trump’s resumption of sanctions on Iran is positioning U.S. pistachio suppliers for big share gains. Iran is the only real rival to U.S. pistachios in terms of production volume followed by Turkey. The estimated carry-over to new crop is going to be smaller than in typical years which may drive firmer opening prices. As we approach the harvest season, focus will be on weather and trade tariffs.

The U.S. pistachio crop is developing well. Expect new crop shipments in October and November. We supply all major grades and sizes of in-shell and kernel Pistachios from the U.S. and welcome your inquiries for new crop.

Figs

Turkish Figs have seen a recent rain while the product is in its most critical stage for harvesting. We have heard reports that up to 40% of figs will be either sour, open-mouthed, or cracked. We have seen this movie before this past year in California raisins. These types of late season rains during critical junctures in the process of harvesting creates major problems that stem from the damage these rains can do. This past year in California, as we have talked about extensively, has shown the monthly shipments to be down some 40+ percent in July vs. this time last year.

This is a big deal for Turkish Figs as it will bring two-fold results to this large export market; 1) We will likely see a large decrease in total available tonnage in the coming year (2018 / 2019) vs last year due to mold, sand, and grit concerns and 2) The price of Turkish Figs will thus begin to climb beginning now through this coming year. We saw the same in California raisins last year, with many buyers holding off the market during the early fall harvest season, when prices were at their lowest they would be all year. This has caused a backlog of orders with lower quality and higher prices. We ultimately recommend that anyone interested in booking their Turkish Fig needs for this season books this business sooner rather than later to avoid the inevitable rises in price and lower quality to be expected from Turkey after the recent rains.

Apricots

The Turkish dried apricot harvest is nearing an end. The quality of the crop is good. The average sizes are in the 3 - 4 range. The estimated carry-in to the 2018 crop is about 30K MT. Organic and non-organic sulfured and unsulfured Turkish apricots are available for export markets in size 3, 4, and 5.

Brazil Sugar

Sugar prices remained low in recent weeks as world market surpluses continued. Large production increases from India and Thailand added to the excess supply situation. After production quotas expired in October 2017, the E.U. sugar industry is facing an extremely challenging export environment given the low price environment. Recent droughts in the E.U. are weighing on production estimates as well.

We supply Brazil origin ICUMSA 45 Sugar by the vessel on a spot (MOQ: 12,500 MT) or forward contract basis including long-term contracts of 300,000 MT / month x 12 months. Payment by SBLC, BG, or DLC confirmed by global top 50 bank.

We supply German Beet Sugar (MOQ: 1 FCL) as well as Thai Sugar (MOQ: 10 FCLs)

Brazil Soy

Brazil’s exports of soybeans are expected to hit an all-time record this year. The 25% Chinese tariff on U.S. soybeans is set to improve Brazil’s relative competitiveness compared to the U.S. In the first half of 2018, Brazil’s exports of soybeans to China increased to approximately 36 million metric tons, up about 6% from the prior year. In July alone, Brazilian soy exports to China rose 46% compared to July last year.

Weak sugar prices are also incentivizing Brazilian farmers to switch from sugar to soy and other crops. According to government data, Brazil’s soy plantings grew by 2 million hectares in two years while, over the same period, planted acreage for cane sugar declined by 400,000 hectares.

We supply GMO and Non-GMO certified Soybeans from Brazil. MOQ: 12,500+ MT. Payment by SBLC, BG, or DLC confirmed by global top 50 bank.

Brazil Corn

Estimates for Brazil’s 2017 / 2018 corn crop declined slightly in recent weeks to 82.1 million tons (MMT) which reflects a decrease of 16% compared to last year’s production of approx. 99 MMT. Brazil’s corn exporters continue to be well-positioned to take advantage of Trump’s trade disputes with key trading partners.

We supply GMO and Non-GMO certified Corn from Brazil. MOQ: 12,500 MT. Payment by SBLC, BG, or DLC from global top 50 bank.

Rice

We offer a wide range of rices from Thailand and Cambodia including Gaba Jasmine, Thai Fragrant, Thai Hommali, Thai Black, Thai White, Thai Red and Thai Parboiled Rices. MOQ: 10 x 20’ FCLs.

Other Products

We work with a number of other products so please reach out if you have an inquiry for something you do not see here. We are experts in sourcing bulk food ingredients and welcome the opportunity to work with you on your inquiries. Some of our other product offerings include sunflower seeds, lentils, green peas, freeze dried fruits, popcorn, dried cherries, dried apples, dried blueberries, cherry concentrate, quinoa, dried honey dates, dried cherry tomatoes, dried gojis, dried kiwis, dried strawberries, chickpeas, chia seeds, dried mulberries, almonds, macadamias, pistachios, walnuts, cashews, pine nuts, pecans, brazil nuts, pumpkin seed kernels, melon kernels, hazelnuts, dried prunes, golden raisins, sultanas, dried apricots, sweet apricot kernels, dried black currants, dried figs, dried dates, popcorns, maraschino cherries, dried tomatoes, strawberry pie filling, blueberry pie filling, cherry pie filling, dried mangoes, dried gingers, dried pineapple, and dessicated coconut.

Work With Us As a Supplier

We are always looking to grow our supplier base with companies capable of delivering continuous high quality product at large volumes. If you are interested, please reach out and introduce yourself.

We welcome your inquiries and look forward to working together to deliver you the highest quality ingredients from the world's best suppliers. We are available to our suppliers and buyers 24/7 over email, phone, or WhatsApp.